10 ways 5G will transform finance

5G – alongside technologies such as edge computing, AR, VR, and the Internet of Things (IoT) – looks set to revolutionize the finance industry.

Financial and banking services are already in the middle of a revolution, and ordinary people have begun spending and managing their money in new and unusual ways. But 5G, alongside other technologies, such as edge computing, AR, VR, and the Internet of Things (IoT), looks set to shift the industry even further, and many commentators argue that most of the changes will show themselves in improved services to end users. People will be able to make payments using wearables, transfer funds in an instant, and talk to their robot financial adviser whenever they want. Here are the 10 major ways we expect 5G to change finance.

1. Financial advice from AI robots

Many financial advisers are already looking into developing robo-advice, an AI driven alternative to a face-to-face service. Robo advisers would act in cases where the advice needed was fairly simple - such as which ISAs a customer can make use of, or how much they need to put into a pension to retire comfortably.

2. Increased security

The processing of information in real time will see better security measures since biometric tests with increased processing power, such as a fingerprint, iris or something else, can be analysed in real time. Behavioural tests, looking at the way a person signs (speed of pen movement, pressure exerted and inclination) or walks (gait and posture), might also be used in banking and finance to ensure a person is who they say they are. These measures could see the immediate transfer of large amounts of money potentially replacing the Bacs, Swift or Chaps payments currently used. The speed of 5G will allow for geolocation information around transactions to be analysed instantly. ‘Unusual spending on an account’ often flagged by banks when a customer is abroad, will be a thing of the past since it will be checked against a customer’s geolocation data.

3. Personalised banking

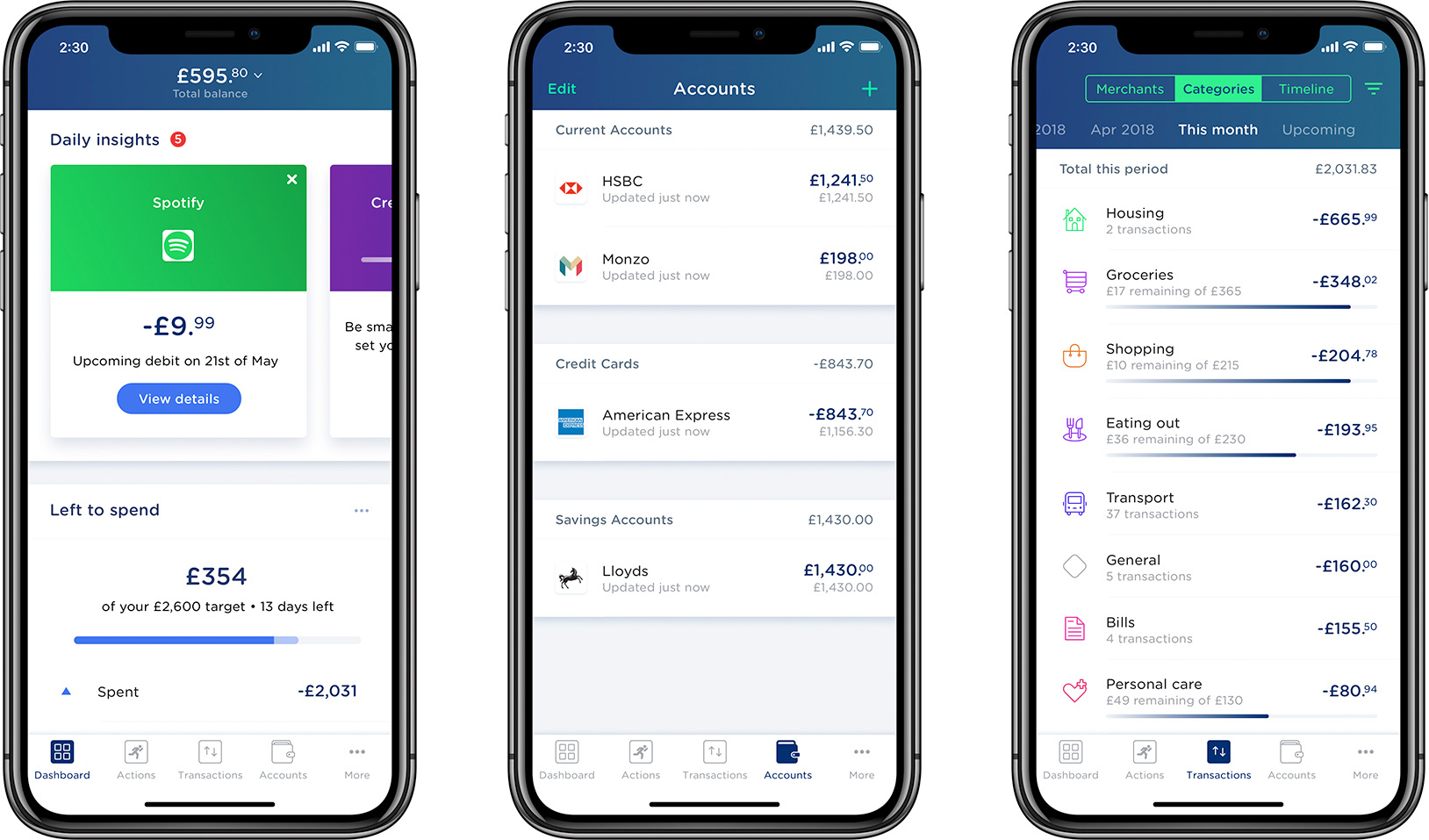

Personalised banking offers much of what an adviser would but need not be offered by one. 5G speeds, low latency and connection with the IoT, is likely to see a proliferation of independent apps offering regular advice to customers as they go about their normal life. It could lead to monitoring of spending habits related to location, suggestions on how to save money at the supermarket, and other nudges encouraging people to put money into a savings bank rather than order a second coffee at the local café.

4. Blockchain and trade finance

The global flow of commodities and goods depend on a system called ‘trade finance’ – these are contracts set up by intermediaries that manage payment and delivery issues. Josias N. Dewey et al from law firm Holland and Knight estimates that trade finance is worth nearly ten trillion dollars a year. The blockchain (often described as distributed ledger technology (DLT)), could cut out most of these costs by using smart contracts managed via the 5G network, thereby cutting out the middle man. A smart contract will be embedded into the blockchain, reducing trade finance to a series of satisfiable actions. For example, when a goods’ laden ship reaches a port (the docking goods would be fitted with IoT sensors), the ledger or smart contract would be altered. Once a shipment had been received by a distributor from a manufacturer, the contract would be altered again, and payment triggered. The shipment could be tracked further too, showing distribution of units, very useful for marketing purposes. This process could save companies millions in costs spent on intermediaries and operations.

5. Faster insurance analysis

When an insurance company receives a claim, following a burglary or a fire for example, appraisers visiting the site might wear AR glasses connected to head office that would relay visual information regarding the damage. The appraiser could assess the damage according to directions from an expert at head office. Insurance companies would be able to serve customers quickly, perhaps even immediately. They will also be able to run claims adjustment processes through an AI system, speeding up the resolution of the claim.

6. Wearable technology and banking

Many people are already making debit payments via their 5G phones, and as 5G technology becomes more widespread, wearables, primarily glasses and watches, are likely to be used to manage money. They are different from smartphones, in that they can offer an even more granular view of a customer’s behaviour and health, which may affect insurance offered by banks, as well as purchasing decisions. From a customer identity perspective, wearable technology can analyse biometrics to authenticate customers at any point in time. 5G-enabled AR glasses will help banks present information more simply, such as 3D rendering of interest on an ISA over time. They could also have easy access to customer support through these glasses.

SIGN UP FOR E-MAIL NEWSLETTERS

Get up to speed with 5G, and discover the latest deals, news, and insight!

7. Pop-up branches and ATMs

The traditional banks’ high street presence has been shrinking for a while, but a pop-up, wireless branch is one way it can maintain services where there isn’t enough demand for a permanent office. Enabled by 5G these will do away with many of the security or performance concerns around fixed-line connectivity. They can offer everything a traditional branch offers but from within a movable hut. A ‘remote teller’ is another form of mobile bank-manager availability. People who would normally go to their local branch to speak to a bank manager would be provided with personal attention via a remote video session. These would likely be made available via a smartphone or personalised ATM.

8. Finance apps will move to the cloud

Third-party open banking applications that gain access to the banks’ databases are already widespread (these include Moneyhub, Money Dashboard and Yolt) and banks are competing with their own applications offering a variety of services. 5G will see these move from the customer’s phone to the cloud, with all data processed there. This will mean a user can manage their money using any access point (such as a car or wearable with almost no processing power). This move to the cloud means transactions or services could be aided by virtual assistants in real time, since latency will be so low. This would allow for more complex queries than are currently possible.

9. Investment management and 5G

Although trading doesn’t affect the ordinary person much, 5G combined with trading might mean investors in pensions or other savings schemes are less exposed to risk. Financial advisers tend to leave investment management to the experts who are constantly tweaking portfolios to maximise returns. This can mean that these portfolios become distorted and do not fit the customer’s risk profile, a problem for both the customer and adviser. It may take an adviser several months to recognise this, since they tend to reassess portfolios at the end of every quarter. 5G-enabled apps and infrastructure will have more capacity enabling powerful data analysis, this could lead to software allowing advisers to automatically run complicated checks ensuring that their clients’ portfolios match their capacity for risk.

10. Seamless micropayments

Micropayments for parking, reading paid-for articles online, or using a WiFi hotspot will be fully automated by 5G. The system could work with a one-click mode, so when passing a ticket terminal, or reading an article, a button on the phone or browser might turn green enabling a quick contribution. Vendors won’t need account information, rather a payment token that is recognised as a valid exchange currency.

- Discover the best 5G networks in the UK and US

- mmWave: the secret sauce behind 5G

- The complete guide to 5G security

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Nicola Brittain is a freelance journalist with expertise in technology, telecoms, media and finance. She worked as news and analysis editor at Computing Magazine, and more recently has freelanced for Diginomica, Investment Week and Portfolio Adviser. She is currently writing a novel.